Bloomberg has quoted data which show that the next big job cuts will be in finance and health care because with “companies with declining revenue per employee and slumping stock prices seem most likely to reduce head count.”

It reports how there was another round of job cuts by Meta Platforms Inc.who has added to the 11 000 people it fired in November with thousands more.

Bloomberg raises the question “Even after the thousands of layoffs we’ve seen in recent months which industries might be looking to toss more staff on the scrapheap? The answer based on an analysis of earnings and stock performance appears to be the financial and health-care sectors.”

According to Bloomberg in the 105 companies present in S&P 500 the average amount of revenue generated by each worker has declined from pre-pandemic that is 2019 which might mean that either sales have declined or management hired new staff faster than it could expand the business in other words “head count growht exceeded sales growth.”

“Of those 105 stocks some 60 have outperformed the broader market over the past year. That might lead you to conclude there’s less pressure on the executive team to right the ship and improve profitability. That won’t of course always be the case. Meta has performed better than the S&P 500 not least because of its earlier layoffs but that doesn’t seem to be stopping Chief Executive Officer Mark Zuckerberg from slashing more jobs. The social media giant’s 14% decline in revenue per employee from 2019 to 2022 was one of the more extreme drops among companies in the index.

Eliminating those companies leaves 45 stocks that both are underperforming the rest of the market and have declining sales per employee. And within that group the biggest cohort is the 12 financial companies followed by 10 health-care companies. Among the big names are Bank of Americaand Citigroupfrom the banking industry both of which employ hundreds of thousands of people as well as the Minneapolis-based medical device maker Medtronic.

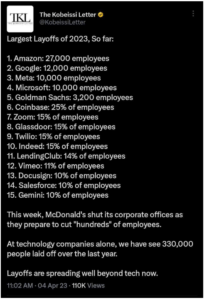

The roster also includes Amazon.com Inc. another tech giant that’s already announced huge head count reductions. But those 18 000 rolesit slashed represent just 1.2% of the 1.5 million people the company employed at the end of 2022. With the stock still trading near historic lows compared with expected earnings founder Jeff Bezos’ lieutenants might well determine there’s scope to cut more.

Companies have other levers to pull to spur sales and profit growth before they resort to staff reductions. Yet even if executive teams are happy to retain their current staffing levels activist investors on the prowl for targets might cite the “bloated workforce” as evidence of current management’s lack of rigor. For America’s beleaguered workforces the bad news may not be over yet.”

We are also witnessing how banks are closing branches.

Besides having major job layoffs in the technological sector will the world witness layoffs spreading well beyond the financial and health care sectors too?

https://www.bloomberg.com/news/articles/2023-03-10/2023-layoffs-finance-health-care-jobs-could-be-next?cmpid=socialflow-twitter-business&utm_medium=social&utm_content=business&utm_campaign=socialflow-organic&utm_source=twitter#xj4y7vzkg&leadSource=uverify%20wall