Rishi Sunak “has family ties to a technology partner of the World Economic Forum that has advocated for a Chinese Communist Party-style economy complete with trackable digital identities and currency.” If the digitised renminbi (RMB the official currency of the People’s Republic of China) is adopted broadly as a system to streamline trade and reduce risk China could become the world’s trade banker as well as its factory.

These connections of Sunak with China remind me of ex-minister Conrad Mizzi and his connections with China too…

Sunak is “also listed as an official partner of Infosys an Indian information technology company that provides services to a host of Fortune 500 companies and banks and remains a foreign citizen with non UK tax-paying status despite his wife being a citizen of India.”[1]Why? Because he happens to be the son-in-law of the founder of this Infosys Narayana Murthy.

Infosyswas described by the WEF as a “global leader in next-generation digital services and consulting” with several of its executives like Mohit Joshi the company’s Global Head President and Chief Compliance Officer contributing with articles in favour of digital banking on the WEF website. So Infosys is a partner to the same WEF.

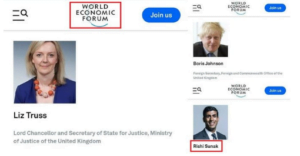

Sunak like Boris and Truss before him happened to be part of the World Economic Forum:

But as the UK battles inflation British consumers are increasingly using notes and coins to help them balance household budgets. According to The Guardian[2] the Post Office released a report that revealed that despite the recent increased use of cards and digital payments on smartphones demand for cash has increased in Summer of 2022. It reported that branches handled £801 million in personal cash withdrawals in July an 8% increase over June. The yearly change from the previous month’s figures was up 20% compared to the July 2021 figure of £665mln.

In July £3.31 billion in cash was deposited and withdrawn across the Post Office’s 11 500 branches a record high for any month in the Post Office’s three-century history.

According to the report rising physical cash demand is primarily due to more people managing their budgets on a “day-to-day” basis with notes and coins. It stated that some withdrawals were made by vacationers in need of cash for “staycations” in the UK. According to the Post Office approximately 600 000 cash pay-outs totalling £90 million were made to people who received government assistance with their power bills.

The Post Office’s banking director Martin Kearsley said that Britain is “anything but a cashless society” adding: “We’re seeing an increasing reliance on cash as a tried-and-true method of budget management”. With inflation and many bills on the rise an increasing number of British are turning to cash once more.

So much for the World Economic Forum central banks and major corporations pushing for cashless societies around the world and more importantly attempting to usher in a hyper-centralized CBDC dystopia.

With physical cash regaining popularity in the UK the transition to a cashless society may be a much more difficult task for Sunak and the Elites than previously thought.

[1]https://share.summari.com/would-be-british-pm-rishi-sunaks-family-runs-a-china-linked-world-economic-forum-partner-company-pushing-digital-id-and-social-credit-scores

[2]https://www.theguardian.com/business/2022/aug/08/cash-comeback-cost-of-living-crisis-post-office