How will governments make nations accept the digital money system as prepared by the Elite or CBDC Can we stop it? Or could it be that everyone who goes digital will have their debts wiped so that the masses will grab it with both hands? And when we say “debts” are we including mortgages and equity? Everyone who desperately needs help especially in a collapsing economy will jump for joy.

Well this was done back in Germany in the 1920s. In 1914 the German mark to the American dollar exchange rate was approximately 4.2 to one. By 1923 it was 4.2 trillion to one nine years later.

During World War I the German government printed unbacked currency and borrowed money to finance military expenditures which led to mild inflation. The strategy was to eventually pay off the debts by seizing resource-rich territories and imposing reparations on the vanquished Allies.

However Germany lost the war and was left with massive debts and reparations to pay to the Allies under the Treaty of Versailles. Inflation began slowly at first then accelerated rapidly in late 1922. In just a few months the exchange rate soared from 2 000 marks to 20 000 to a million and beyond riding a rising tide of economic panic and mistrust.

Germany was already experiencing high levels of inflation as a result of the effects of the war and rising government debt. ‘Passive resistance’ meant that while the workers were on strike fewer industrial goods were produced further weakening the economy. The price of a loaf of bread rose from 250 marks in January 1923 to 200 trillion in November when Adolf Hitler and the Nazi Party attempted the failed Beer Hall Putsch.

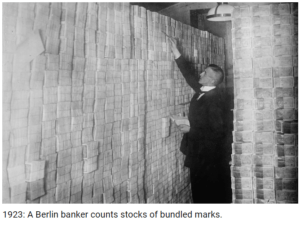

In 1923 at the height of German hyperinflation the exchange rate between the dollar and the Mark was one trillion Marks to one dollar and a wheelbarrow full of cash could not even buy a newspaper. This financial storm caught most Germans off guard. They struggled to survive in increasingly absurd conditions as the government commissioned 130 printing companies to produce piles of increasingly worthless currency. Many even chose to avoid currency altogether placing their faith in tangible assets to barter goods.

1923: A Berlin banker counts stocks of bundled marks.

1923: A Berlin banker counts stocks of bundled marks.

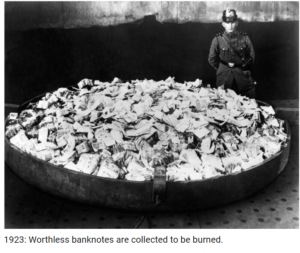

As the first repayments to the Allies were made in the early 1920s the value of the German mark plummeted and a period of hyperinflation began. In early 1922 one US dollar was worth 160 German marks. The currency would depreciate to 4 200 000 000 000 marks to one US dollar by November 1923. Money became so worthless that people used to even stick it to the wall. So then the Rentenmark was the currency issued on 15th October 1923 to stop this hyperinflation which was then replaced in 1924 by the Reichsmark issued by the Central Bank.

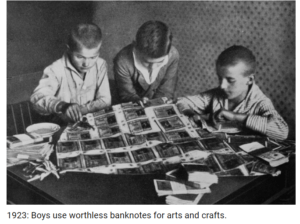

1922: Children playing with virtually worthless marks

1922: Children playing with virtually worthless marks

The hyperinflationary fever was finally broken in late 1923 when the government began issuing the new rentenmark a currency backed by mortgages on agricultural and industrial land with the old exchange rate of one US dollar to 4.2 rentenmarks. The foundation of the new currency was shaky at best but years of terrifying instability had made the German people desperate enough to trust it.

1923: Boys use worthless banknotes for arts and crafts.

1923: Boys use worthless banknotes for arts and crafts.

Though the crisis was over the trauma inflicted on the German people lingered and aided the rise of embittered radicalism in the years that followed helping Hitler to rise to power.

With the rise of Hitler to power prices and wages were under control and money had become plentiful. This meant that people started to amass large amounts of paper assets again. But historians are showing that the official prices and wages did not reflect reality as the black market dominated the economy as war started and more than half of all transactions occurred unofficially.

The fall of Hitler and the end of the Second World War could have lead Germany to experience another period of hyperinflation. Germany went through another monetary reform by replacing the old money in circulation in Nazi Germany with new money.

Moreover this time round Communism was conceived as a threat to the Western World. Thus Western Europe witnessed the arrival arrival of $1.4 billion in Marshall Plan funds from the United States which was primarily used for investment.

The Marshall Plan compelled German companies as well as those throughout Western Europe to modernize their business practices and consider the larger market. Marshall plan funding alleviated bottlenecks in the booming economy caused by remaining controls (removed in 1949) and opened up a vastly expanded market for German exports. Overnight consumer goods appeared in the stores because they could be sold for higher prices.

While most historians today regard the availability of consumer goods as a huge success story the perception at the time was quite different: prices were so high that average people could not afford to shop especially since prices were free-ranging but wages were still fixed by law. As a result a massive wave of strikes and demonstrations swept across West Germany in the summer of 1948 culminating in an incident in Stuttgart in which strikers were met by US tanks (“Stuttgarter Vorfälle”). Only after the wage-freeze was abandoned Deutschmark and free-ranging prices were accepted by the population.

History here is showing us how the German people were made to first accept the Reichsmark and then the Deutschmark where everyone started on the same level playing field since money was worthless.

Will history repeat itself in the quest to make people accept the CBDC?

1923: Worthless banknotes are collected to be burned.

1923: Worthless banknotes are collected to be burned.