The agenda to drive nations to live in cashless societies has been slowly infiltrating our lives for years now. It started with the banks and then with direct debit payments and then the grant of mortgages against proof of payslips to the introduction of ATMs and bank cards to the reliance on online banking services and then the shift towards contactless cards and now with the introduction of the microchip which will enable payment with the palm of the hand. All this is sold to you as convenient and safe.

Card payment brings with it more expenses for business owners too as this post I came across shows:

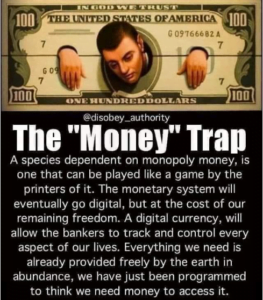

The more we accept to live on such dictated terms and conditions the more we are controlled. But the plans of the Establishment are otherwise. For the sake of not letting a crisis pass by or for that matter a market crash with the equity and bond markets in deep bear markets they are providing sufficient distractions from what is going on behind the scenes. On 15thNovember Reuters[1]reported that a 12-week digital dollar pilot project called “the regulated liability network” is going to be started by global banking giants with the participation of financial companies like Citigroup Inc HSBC Holdings Plc (HSBA.L) the payments network Mastercard Inc (MA.N) and Wells Fargo & Co (WFC.N). Other participants are the Bank of New York Mellon the money-laundering bank of the world PNC Financial Services Toronto-Dominion Bank Trust Financial and U.S. Bancorp.

This means that the plan that they have been quietly preparing for so to drive the world onto the next stage is now being announced in the rollout of CBSC which is a planned and “organized crash” pipeline.

This “experiment” as called by Reuters will be done with the Federal Reserve Bank of New York and its innovation centre conducted in a test environment and the usage of simulated data.

The innocuous motive they give you is to see how banks can help speed up payments by using digital dollar tokens in a shared database.

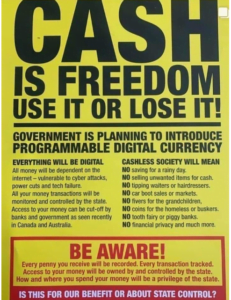

Now digital money in this case “digital dollar” does not have the same meaning as what you have been accustomed to. It is not digital but it is connected to a blockchain. It is “programmable cash”. And this is exactly what they are planning round around the corner and it is heading to us like a freight train.

The CBDC’s are being rolled out by the central banks around the world which means every transaction that people make is tracked on blockchain. I also dare say that it will permit the establishment to allow people what they have access to or what they don’t have access to while also being linked to their carbon footprint tracker to their digital license to their digital annual vaccination status and so forth.

Every move you make will be tracked and traced and according to your moves you will be given or denied access.

In this 12-week project they will settle things and transactions on a distributed Ledger. It is a sign that Wall Street intends to push ahead with its cryptocurrency agenda despite what is happening in the markets as part of some staged events.

When this whole thing shifts over it means that we have no more privacy in a world which has turned into a Big Brother. Because while the initial work will concentrate on simulating digital money issued by regulated institutions in US dollars the concept could be expanded to include multicurrency operations and stablecoins which are typically backed one-to-one by another asset such as the dollar or euro.

And while these central banks and globalist institutions backed up by the World Economic Forum are rushing to transition the world to digital currencies Austrian citizens have delivered a massive grassroots rejection of ending cash when more than half a million “have signed a petition calling for a referendum on the constitutional enshrining of the right to unlimited cash payments.[2]

We must all follow the Austrians and aim to have the Constitution amended to include “the right to pay in cash without any restrictions” in our crusade to keep the cash against their crusade upon us to end the cash.

[1]https://www.reuters.com/markets/currencies/banking-giants-new-york-fed-start-12-week-digital-dollar-pilot-2022-11-15/

[2]https://www.riotimesonline.com/brazil-news/modern-day-censorship/over-500000-austrians-demand-right-to-cash-payments-be-added-to-countrys-constitution/