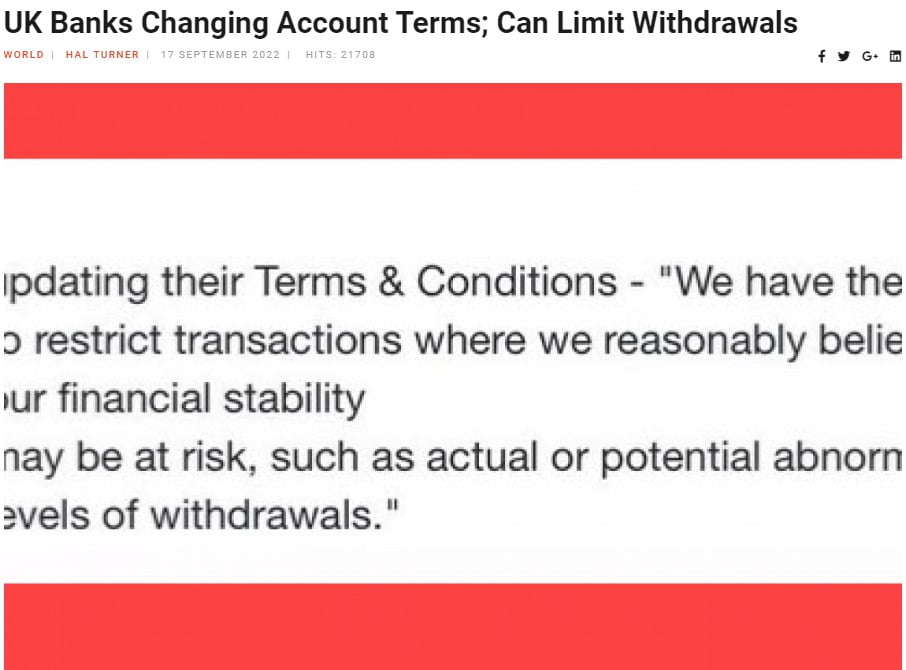

On the 17thof September an article entitled “UK Banks Changing Account Terms; Can Limit Withdrawals” was published by Hal Turner Radio Show[1]and a few other media portals.

The article reads:

“Account holders at Yorkshire Bank for instance received notification that the Bank changed account terms to say “We have the right to restrict transactions where we reasonably believe our financial stability may be at risk such as actual or potential abnormal levels of withdrawals.

Put simply if a whole slew of depositors starts losing faith in the bank and start taking THEIR money out then the bank gives itself the right to prevent YOU from taking YOUR money out.

Changes like this don’t happen by chance or for no reason. It seems logical to many account holders that the reason the banks are doing this is that they fear something in the future will cause people to come withdraw their money.

Bank account holders in the UK should look carefully at their account terms to see what rights the banks give themselves. It may actually be safer for people to keep a significant portion of money OUT of banks. This way YOU can get to it no matter what happens to THEM.”

Well let’s face it. Even in Malta we have a limit of how much money we can withdraw in a day from an ATM. Also many Maltese citizens grumble about the fact that whenever they have to withdraw a lump sum from their account they are asked a million of private questions when at the end of the day it is their money. And since the bank had no questions whatsoever when this money was deposited and with which it was entrusted with then the same bank should not have any problem when the holder of such money wants to take it out.

I can understand the same context if I were to want a loan but not if I want to withdraw a lump sum of money from my account.

But if the above article is true what are British banks fearing? Why are they limiting or refusing withdrawals that may affect their financial stability?

This is not understandable considering that for example in the U.S. banks are flooded with cash. And cash and deposits for banks are a way of liability because they have to pay interest on it even if it is one tenth of one percent it is still a liability to them. So they would rather loan it out and that is what they are doing.

All the excess cash that the American banks have is sent every night to the Federal Reserve in a process called Reverse Repo which holds it in its balance sheet and it goes ahead and pays these banks interest on that money. Even though it might be little when you multiply that fraction of a percent like a quarter of a percent by billions and billions and billions it adds up.

But it seems that British banks are getting for bank runs “such as actual or potential abnormal levels of withdrawals.” Who gets to define what abnormal levels of withdrawals are? So if a customer wants to withdraw £10 000 from the bank to buy a car the bank can refuse because as soon as you deposit money into a bank you are now an unsecured creditor to that bank meaning that the money is no longer yours.

If a whole slew of depositors started losing faith in the bank and started taking their money out then the bank gives itself the right to prevent you from taking your money out. Changes like these don’t happen by chance or for no reason.

Although such news might look innocuous to readers I firstly would like to state that nothing happens by chance especially when it comes to bankers and governments. In addition there are a lot of changes going on in banks worldwide at the moment as I will show you in future writings so something must be rolling.

[1] https://halturnerradioshow.com/index.php/en/news-page/world/uk-banks-changing-account-terms-can-limit-withdrawals?EdNo=002