As I have pointed out in another blog a lot of banking articles are appearing all dated August and September with changes going on in banks.

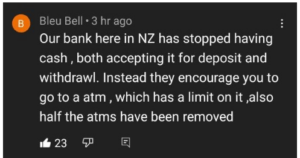

The comment below shows the current situation in New Zealand:

And while people are being pushed to use ATMs the Independent UK has reported that in New York criminals are using a new form of super-thin “deep insert” ATM skimming devices placed inside the card slot of an ATM in an invisible way for others with a tiny pinhole camera disguised as part of the ATM which then captures a person’s PIN code as they type it in.[1]

So much for the banks as the safest place to keep your money!

As of the 1st of last August Israel started no longer accepting cash payments of more than $1 760 in cash and bank cheques. A member of Israel’s Tax Authority specifically said that they want the public to use less cashin a reform that aims to combat organized crime money laundering and tax evasion. In their words: “The goal is to reduce cash fluidity in the market mainly because crime organizations tend to rely on cash. By limiting the use of it criminal activity is much harder to carry out.”[2]

In the US the US Banks deposits fell by a record of $370 billion in the second quarter of this year which is the first decline since 2018.[3]“The outflaws will fuel a debate how the Fed’s inflation-calming moves are going to play out in the banking system. Deposits fell to $19.563 million as of June 30 down from $19.932 million in March according to the Federal Deposit Insurance Corporation.”

Speaking at the Kansas City Fed’s annual symposium in Wyoming Federal Reserve Chairman Jerome Powell said that the central bank must continue raising rates until it is confident inflation is under control because inflation is bringing about some pain. A series of US Federal Reserve rate (Fed) increases is now removing some of that money from the system in part by decreasing demand for loans and increasing demand for government bonds. This deposit outflow will fuel speculation about how the Fed’s efforts to tighten monetary supply and slow the rate of inflation will play out in a banking system flooded with liquidity.

The US Treasury Department announced in September that it is ready to impose sanctions on any institution outside Russia which uses the Russian payment system.[4]“According to its press release financial institutions that enter into new or expanded agreements with the National Payment Card System (NSPK) ‘risk supporting Russia’s efforts to evade US sanctions through the expanded use of the MIR National Payment System outside the territory of the Russian Federation’.” Previously the US threatened to sanction foreign banks particularly Turkish financial institutions for cooperating with the Mir system.

Also in September Argentina’s central bank raised the country’s benchmark interest rate by 550 basis points to 75% a day after inflation surpassed forecasts to near 80% on an annual basis. The increase followed a 950 basis point increase in the 28-day Leliq benchmark rate in August as the government tries to bring down spiraling prices that are harming Argentines’ savings and salaries and undermining the Peronist government’s popularity.[5]

In the same month “the Bank of Canada hiked its interest rate by three-quarters of a percentage point to 3.25% to try to cool red-hot inflation which has risen to its highest level in decades.”[6]The regulator is expected to hike the rate again this October by another half point.

In England “it is expected that interest rates will be hiked for the seventh month in a row as it seeks to stem high prices. Economists expect the Bank of England to raise the base rate from its current 1.75% to rein in inflation which was running at 9.9% last month– the highest in the G7 group of leading economies and almost five times the Bank’s 2% target.”

It comes as no surprise that according to the same bank’s survey British households are losing confidence in it since they are dissatisfied with the way it is handling and controlling the inflation crisis. This was “the worst reading since records started in 1999 and pushed net satisfaction to -7%.”[7]

[1]https://www.independent.co.uk/tech/atm-skimmer-new-york-security-b2168000.html

[2]https://www.i24news.tv/en/news/israel/economy/1659279727-israel-bans-use-of-cash-for-purchases-over-1-760

[3]https://www.wsj.com/articles/u-s-banks-lost-a-record-370-billion-in-deposits-last-quarter-11663030297

[4]https://www.azerbaycan24.com/en/us-targets-banks-using-russian-payment-system/

[5]https://www.cnbc.com/2022/09/16/argentina-hikes-interest-rate-by-550-basis-points-to-75percent-after-inflation-overshoots.html

[6]https://www.tasnimnews.com/en/news/2022/09/18/2775896/canadians-wealth-suffers-biggest-drop-on-record

[7]https://uk.finance.yahoo.com/news/bank-of-england-inflation-153515845.html