While the Times of Malta and other international media portals are giving us the picture that sky-high US inflation has eased while traders attempted to guess the size of the next US Federal Reserve interest rate hike[1] other media portals are giving us the opposite scenario.

The crash has begun.. AT&T tumbles as Americans have zero disposable income and stop paying their phone bills. With the current food & energy price increase rapidly rising food prices are the death knell of the economy.[2]

Following comments from CEO John Stankey that customers are beginning to put off paying their phone bills AT&T’s stock price dropped and as a result the telecom provider lowered its expectation for free cash flow this year by $2 billion according to Bloomberg.

Consumer weakness increased the strain on AT&T which has already suffered losses from steep discounts on new phones and major expenditures on network infrastructure. The company now anticipates $14 billion in free cash flow in 2022 with $1 billion of the decreased amount related to the “timing of client collections.” The announcement also affected peers Verizon and T-Mobile sending shares lower. It overshadowed second-quarter results that beat profit and wireless customer growth.

“I’m not surprised to hear consumers are paying bills more slowly; they are already struggling with higher food and energy prices ” said Wolfe Research analyst Peter Supino. “I’m not worried so much for AT&T as I am for the broader consumer economy. You wonder if this is the canary in the coal mine.”

And as a reminder the so-called strong consumer is draining savings at an almost unprecedented pace while relying on credit cards to cover the soaring cost of living.

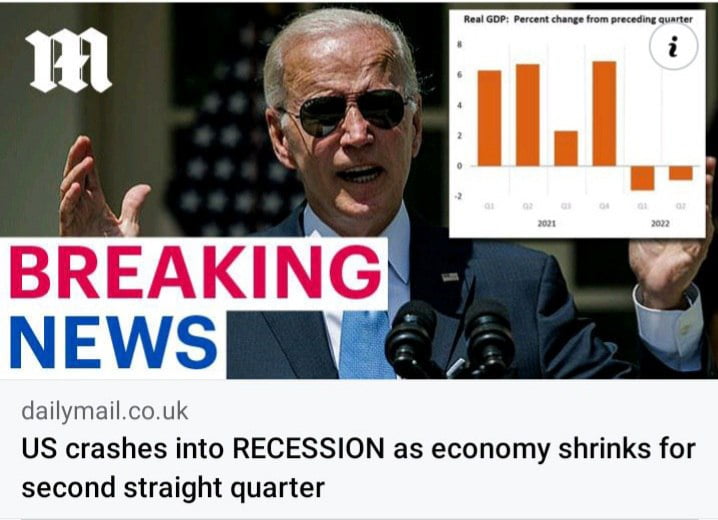

The Daily Mail now also reported that “America goes into RECESSION after a second straight quarter of negative growth but Biden insists: ‘We are on the right path.’”[3]

Although the Commerce Department said in a report on Thursday 28th July that US gross domestic product shrank 0.9 percent in the second quarter following a decline of 1.6 percent decline in the first quarter Biden is ignoring the fact that the US economy has contracted for two straight quarters meeting the traditional definition of a downturn and that America is about to enter one.

Instead he stated that “It’s no surprise that the economy is slowing down as the Federal Reserve acts to bring down inflation. But even as we face historic global challenges we are on the right path and we will come through this transition stronger and more secure.” The “but” already shows that he is confirming the fact that America is entering a recession. These politicians live in a different reality.

This latest report from the Commerce Department came as a surprise because most experts had anticipated a slight GDP increase in the second quarter. Even in Malta we had “experts” and “opinion-ists” in The Times of Malta saying that now the only way is up and that the economy will recover.[4][5]One wonders when we have been warning of the Great Reset all along.

Before the Federal Reserve’s next policy meeting in September investors might be hopeful that the weakening economy will force the central bank to suspend or reverse its aggressive course of interest rate hikes. The Fed has been raising the benchmark interest rate to combat the inflation that is out of control but higher rates tend to slow down growth since it becomes more expensive for consumers and businesses to borrow money.

The informal and generally accepted definition of a recession is two consecutive quarters of negative GDP growth. By providing comments and briefings to promote their narrative that the economy is still strong the White House has been ferociously fighting the idea that six months of economic contraction constitutes a recession.

In a statement the White House said: “While some maintain that two consecutive quarters of falling real GDP constitute a recession that is neither the official definition nor the way economists evaluate the state of the business cycle.”

The statement added: “it is unlikely that the decline in GDP in the first quarter of this year—even if followed by another GDP decline in the second quarter—indicates a recession.”

At which point in time will Europe and Malta enter the recession? Or will they not?

[1]https://timesofmalta.com/articles/view/stock-markets-mostly-rise-oil-drops.974075

[2]https://www.zerohedge.com/personal-finance/state-us-consumer-att-crashes-americans-cant-afford-pay-their-phone-bills

[3]https://www.dailymail.co.uk/news/article-11057997/Recession-economy-shrinks-second-straight-quarter.html

[4]https://timesofmalta.com/articles/view/2021-predictions-is-the-worst-now-behind-us.842445

[5]https://timesofmalta.com/articles/view/a-dash-of-hope-kevin-james-fenech.947605