The beast system is slowly creeping its way into many countries all over the world under the guise of narratives portrayed as beneficial with the key ingredient of deceit.

It is a pity that the Maltese nation cannot see beyond the shadows. Newsbook[1]reported that 61% of the Maltese has said that the 1c and 2c coins should be removed completely and instead shops should ensure that the products cost a fixed amount such as €8 instead of €7.99 while inflation is leading to hyperinflation to stagflation.

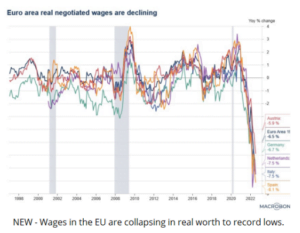

According to a Eurobarometer survey 78% of the Maltese believe that the Euro currency is beneficial for the country. Are they aware that wages in the EU are collapsing in real worth to record low?

In addition 75% of the Maltese agree with the agendas of the New World Order because they said that the prospect of having the EU giving financial aid to member states to launch green digital and social reforms is something positive. In my opinion this is the start of the walk of Malta towards a cashless society paving the way for the digital system a dystopian future which is inevitably coming.

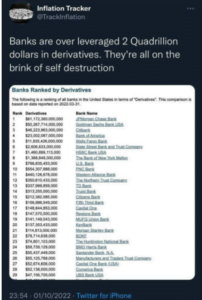

The truth is that the world is in debt of billions and trillions of dollars and there is no way for countries to pay all this debt back. Many banks are collapsing but it does not mean that currency won’t be replaced. What will be ushered in?

What will be ushered in is the process of introducing CBDCs. Simply put a CBDC is digital money issued by a central bank that is the digital monetary system being currently implemented all over the world. Once it is humans will be under complete financial control tied to their birth certificates purposefully created as slave contracts.

Many banks abroad have now started the move towards becoming digital. One certainty with this digitalisation of money is that it comes with an expiration date. “China is exploring expiration dates with its upcoming digital yuan (DCEP) which is programmable to the point that it can be made to expire forcing consumers to use it up to a certain date.”[2]

This is a system which is being pushed by worldwide governments for censorship tracking taxing no privacy centralisation full control over many aspects of one’s personal life freezing of funds.

The Banks of Russia (CBR) are also planning to start testing the digital ruble with fifteen banks so “to open wallets on the digital ruble platform how to make transfers between customers how pay for goods and services including via QR codes” with its launch being April 1 2023.[3]

The Reserve Bank of Australia (RBA) is also expecting to complete its CBDC pilot project by mid-2023 according to the publication of a white paper so to “explore innovative use cases” while seeking feedback from industry participants.[4]

The National Bank of Kazakhstan is setting to integrate its CBDC on Binance’s blockchain network BNB Chain which has begun testing a digital iteration of its national currency the Kazakhstani tenge in 2021 in order to decide on launching a CBDC by the end of this year.[5]

Canadian banks have joined forces while building the capability to issue a digital version of the Canadian dollar because according to the Bank of Canada these are changing times in which “the day may come when Canadians can no longer readily use cash or when an alternative private digital currency becomes widely adopted. That might be the tipping point when a CBDC could be needed.”[6]But on its website it left out the statement done by Deputy PM Chrystia Freeland:

“As of today a bank or other financial service provider will be able to immediately freeze or suspend an account without a court order.” “They will be protected from civil liability for actions taken in good faith.”

Deputy PM Chrystia Freeland: “as of today a bank or other financial service provider will be able to immediately freeze or suspend an account without a court order.”

Deputy PM Chrystia Freeland: "as of today, a bank or other financial service provider will be able to immediately freeze or suspend an account without a court order."

"they will be protected from civil liability for actions taken in good faith."https://t.co/DEN7zzSz9G pic.twitter.com/cm2HkTe61O

— Rebel News (@RebelNewsOnline) February 14, 2022

The Reserve Bank of India (RBI) has announced its first digital Rupee pilot which has commenced on 1stDecember so to test “the robustness of the entire process of digital rupee creation distribution and retail usage in real time”. It will have four participating banks four cites with expansion to come.[7]

The Biden administration has released a framework outlining the regulation of digital assets to move closer to developing a digital currency for the U.S. so to strengthen America’s role as a global financial leader.[8]

In the Netherlands and England there have been huge protests against this enslaving project:

And while the preparations for a digital concentration camp are in full swing we are waiting with abated breath for any announcement as to how our financial freedom is going to be taken away from those who hold the governing and financial altar in the building on St James’s Bastion and Finance Ministry after taking orders from the European System of Central Banks (ESCB).

[1]https://newsbook.com.mt/61-tal-maltin-jaqblu-li-l-muniti-z-zghar-ghandhom-jitnehhew/

[2]https://bfsi.economictimes.indiatimes.com/news/policy/digital-currency-yuan-comes-with-an-expiry-date-spend-or-it-will-vanish/82059471

[3]https://thepressunited.com/updates/schedule-for-testing-digital-ruble-announced/

[4]https://www.coindesk.com/business/2022/09/26/australias-cbdc-pilot-to-be-completed-in-2023/

[5]https://www.coindesk.com/policy/2022/10/27/kazakhstan-to-test-national-digital-currency-on-bnb-chain-binance-ceo-zhao-says/

[6]https://www.bankofcanada.ca/research/digital-currencies-and-fintech/projects/central-bank-digital-currency/

[7]https://www.theregister.com/2022/11/30/indias_retail_cbdc_pilot_starts/

[8]https://www.investopedia.com/inside-the-new-white-house-framework-for-regulating-digital-assets-6674517